13 Pieces of Bad Financial Advice That People Still Believe

In the digital age, where advice is as plentiful as it is varied, discerning the worthwhile from the worthless is crucial, particularly concerning your finances.

I am a Chartered Financial Analyst with more than 20 years of experience in Financial Services. I actually retired young, so I decided it’s time to dispel 13 common financial myths that continue to mislead and confound.

Table of Contents

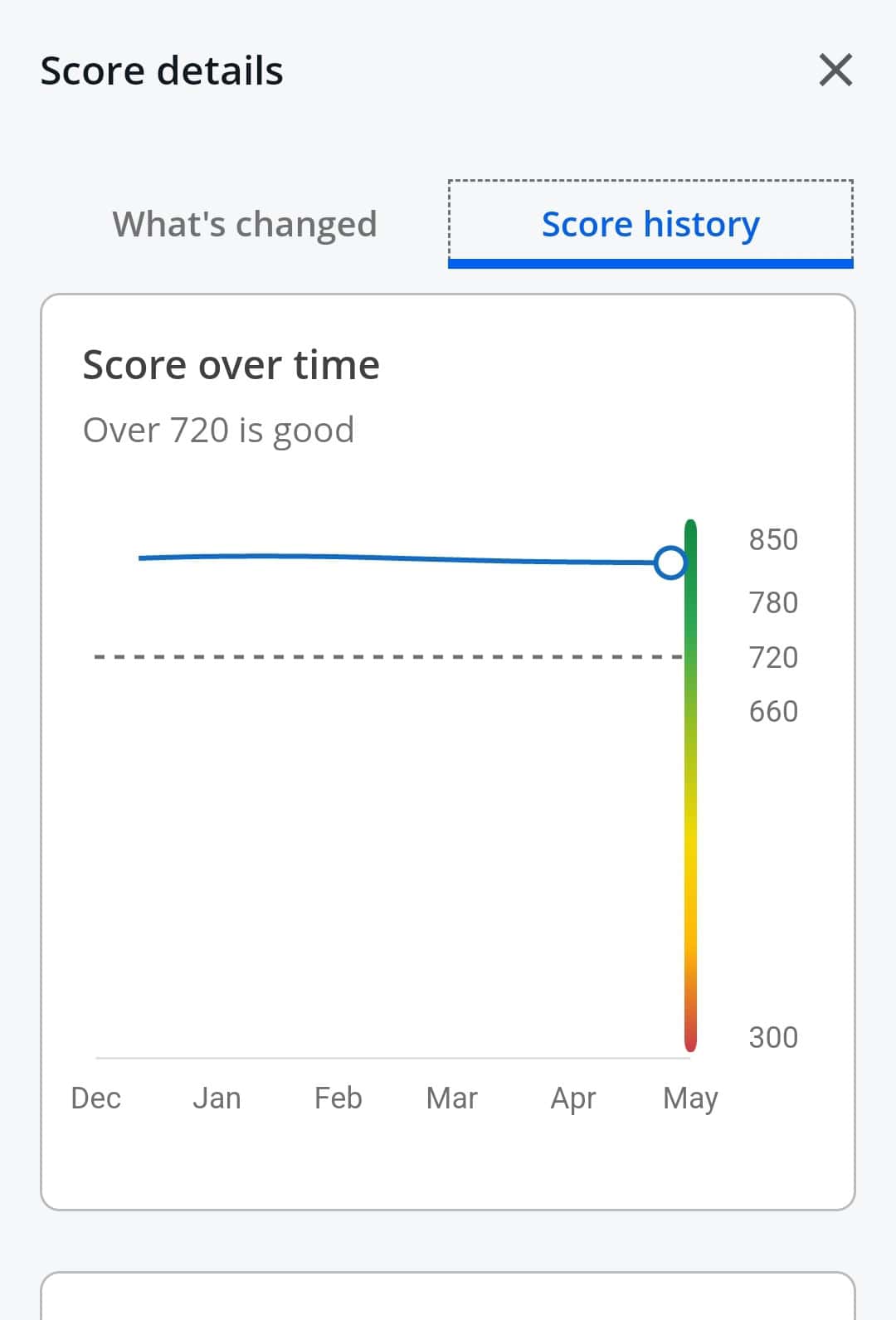

Myth 1: Maintaining a Credit Card Balance Boosts Your Credit Score

Contrary to popular belief, you don’t need to carry a balance on your credit card to enhance your credit score. Your score benefits from responsible credit use, including keeping your credit utilization low and making timely payments.

I’ve had credit card balances of more than $50,000, and I often do not have any credit card balances. Either way, my credit score is usually around 830.

Forget about maintaining a balance; focus instead on timely, full payments to truly build your creditworthiness.

Related: How Many Credit Cards Is Too Many? An Expert Answers.

Myth 2: Hold Off on Investing Until All Debt Is Cleared

While clearing debt is crucial, delaying investments until you are debt-free could mean missing out on valuable financial growth opportunities. Instead, strike a balance: allocate funds for debt repayment and simultaneously invest wisely.

It’s a math problem. You want to build one snowball at the same time that you are decreasing another snow ball.

This approach not only speeds up debt clearance but also fosters a healthy investment habit early on.

Myth 3: All Debt Is Detrimental

The blanket statement that all debt is bad is overly simplistic. Strategic debts, like those for acquiring assets or investments, can actually serve as leverage to amplify your financial portfolio.

It’s about the purpose and management of the debt that determines its impact on your financial health.

I would not have been able to retire at 42 had I not taken out debt. I bought rental houses in my early 20s with a total of $800 out of pocket. While this is an extreme example that won’t work for most people, the point is that debt isn’t bad if you pay it back and the debt makes you more money than it costs.

Myth 4: Wealth Building Is Impossible with a 9-5 Job

This myth undermines the financial potential of traditional employment. Building wealth isn’t exclusive to entrepreneurs. With strategic planning, continuous skill enhancement, and smart financial decisions, employees can also accumulate significant wealth over time.

Granted, it is considerably harder to become wealthy solely off of salary. This is true for many reasons covered in The Millionare Next Door. Some of those reasons are taxes, only having one income stream, not making money while you’re sleeping, and a tendency to spend to keep up with the Jones’.

Related: What Is Side Hustle Stack? Side Hustle Stack Explained Simply.

Myth 5: Your Credit Score Is Irrelevant

This dangerous myth can lead to complacency in managing credit health. A good credit score can secure favorable terms on loans and insurance, reduce security deposits, and even influence your rental applications.

It’s a numeric summary of your financial responsibility. Ignore it at your peril.

Related: 10 Reasons Why A Good Credit Score Will Save You Money

Myth 6: Skip the Emergency Fund; Just Use Credit Cards

Relying solely on credit cards for emergencies is a precarious strategy. High-interest rates and potential for debt make this a risky choice.

Building an emergency fund that covers at least six months of expenses provides a safer, more stable financial cushion.

Myth 7: Buy Now, Pay Later Is Always a Smart Choice

While tempting, the buy now, pay later schemes often lead to financial pitfalls due to unregulated repayment terms and potential hidden fees.

Understand your financial habits and thoroughly read the terms before engaging in such agreements to avoid future financial strain.

Myth 8: A Savings Account Alone Suffices for Retirement

Relying solely on a savings account for retirement is insufficient due to low-interest rates and inflation. Diversifying your retirement savings with investments in stocks, bonds, and mutual funds is essential for a financially secure retirement.

Related: Should I max out my 401k?

Myth 9: Credit Cards Are Inherently Bad

Credit cards, when used wisely, are excellent financial tools for managing cash flow and building credit. They offer rewards and benefits that can save money in the long run. The key is in responsible usage and paying off balances in full each month.

Myth 10: Bankruptcy Is an Easy Escape from Financial Woes

Bankruptcy should be a last resort, not a quick fix. It can relieve certain debts but comes with long-term repercussions, including significant impacts on your credit score and financial standing.

Exploring alternatives like debt consolidation or restructuring should be prioritized.

Myth 11: Savings Accounts Are the Best Investment Vehicles

While savings accounts offer liquidity and security, they yield lower returns than other investment options. Investing in higher-yield assets is crucial for long-term goals, particularly retirement.

Myth 12: Renting Is Money Down the Drain

Renting can be a financially savvy choice, especially for those valuing flexibility or not yet ready to commit to the financial responsibilities of homeownership. It’s not throwing money away if it aligns with your lifestyle and financial goals.

That said, there are significant benefits to owning a home. You are able to put a very small amount down and build equity over a long time horizon. But if your goal is liquidity, then owning is not the right option.

Related: How To Buy a House with Little or No Money Down (I Have Done It)

Myth 13: Avoid Stocks, Stick With Bonds

While stocks do carry more risk, they also offer higher potential returns, which are essential for long-term wealth accumulation and inflation protection. Diversification is key: balancing stocks and bonds can help manage risk while promoting growth.

Good Financial Advice

As we navigate the complexities of personal finance, let’s commit to informed, reflective decision-making. By debunking these myths, we empower ourselves to craft a more secure and prosperous financial future. Remember, in the realm of finance, knowledge truly is power.