Finance Expert (With 820+ Credit Score) Debunks Credit Card Myths

In today’s fast-paced world, understanding credit cards is crucial. Credit cards often come with misconceptions. For budget-conscious families, debunking these myths is essential.

I’m going to debunk credit card myths in this article. But why listen to me? I am a Chartered Financial Analyst with more than 20 years of experience in Financial Services.

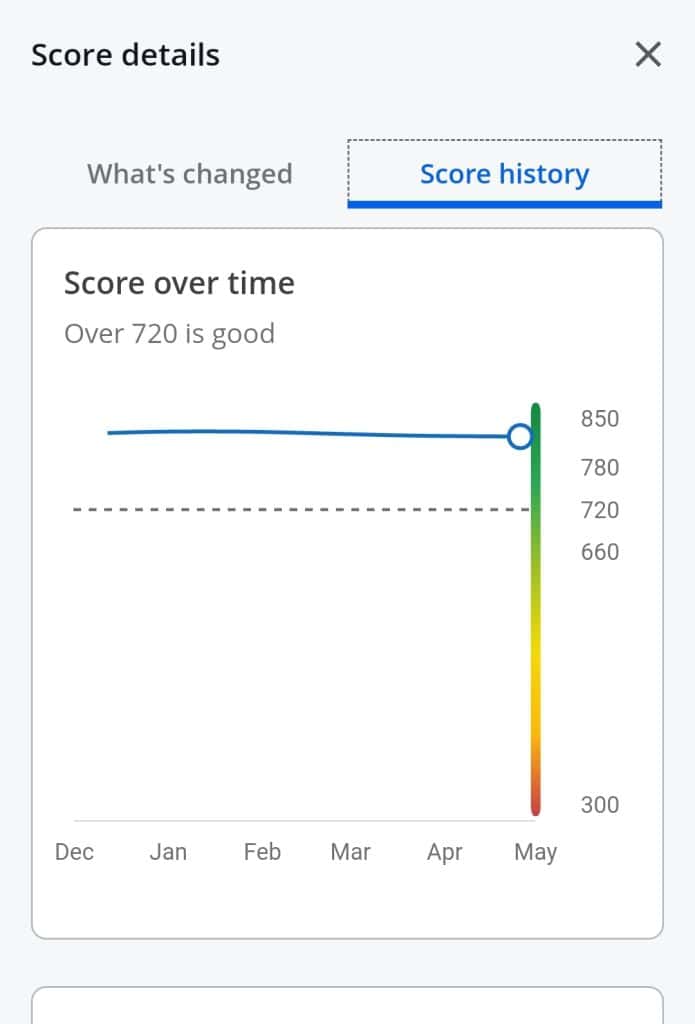

I have had a credit score in the 800s from when I made $25,000 without a penny to my name to today. I also retired at 42 a few years ago. So this is something I know a thing or two about. This image is my score.

Table of Contents

Credit Cards Always Lead to Long Term Debt

There’s a common belief that credit cards are a straight path to debt. Stories of individuals falling into massive debt due to reckless spending are common. According to Experian, the average credit card balance in the U.S. is $5,525. However, this doesn’t have to be the case.

When used responsibly, credit cards can be a valuable tool. They offer convenience, security, and rewards. The key is to understand how to use them without building debt.

Personally, I love credit cards because it makes budgeting easier for me. I know here every penny goes. But that takes discipline.

Set a budget and stick to it. Pay off the balance in full each month. Use credit cards for planned purchases.

Related:

Carrying a Balance Improves Your Credit Score

Many believe that carrying a balance can boost their credit score. This is a misconception. Carrying a balance means paying interest, which is unnecessary.

According to FICO, payment history accounts for 35% of your credit score, and amounts owed (including credit utilization) account for 30%.

Credit scores are calculated based on various factors. Payment history and credit utilization are the most significant. Carrying a balance does not positively impact these factors.

Keep credit utilization below 30%. Pay bills on time. Monitor credit reports regularly.

Closing Old Credit Cards is Good for Your Credit Score

Closing old credit cards can negatively affect your credit score. The length of your credit history is a significant factor. A longer credit history generally indicates responsible credit behavior.

When you close an old credit card, you reduce your overall credit limit. This shortens your credit history and can lower your credit score.

Reduce usage instead of closing. Keep cards active with small purchases. The card I use every day is from the 1990s, when I was still in college.

Applying for Multiple Credit Cards Hurts Your Credit Score

It’s important to differentiate between hard inquiries and soft inquiries. Hard inquiries occur when a lender checks your credit report as part of a credit application. Soft inquiries occur when you check your own credit or when a lender pre-approves you for an offer.

Applying for multiple credit cards in a short period can lead to several hard inquiries. This can temporarily lower your credit score, but this impact is typically temporary and small if managed wisely.

Space out credit card applications. Research and choose the best fit.

Related: How Many Cards Is Too Many? An Expert Answers.

Credit Cards Have Hidden Fees that Make Them Unworthy

Credit cards can come with various fees. These include annual fees, late payment fees, and foreign transaction fees. However, these fees can often be avoided or minimized with careful management. They are also never hidden. You just have to read the terms.

Choose no-fee cards. Pay attention to billing cycles. Look for cards with beneficial perks.

Credit Cards Are Only for Big Purchases

Some people think credit cards should only be used for significant expenses. This myth can limit the benefits you can get from using credit cards for everyday purchases.

Using credit cards for routine expenses like groceries and utilities can help you accumulate rewards and build credit. It also provides an added layer of security and can simplify budgeting by consolidating expenses into one monthly payment.

Use credit cards for everyday purchases. Track spending through monthly statements. Redeem rewards for routine expenses.

Credit Card Rewards Are Not Worth the Effort

Another common myth is that credit card rewards programs are complicated and not worth the effort. While it can be true that some rewards programs are complex, many are straightforward and offer significant benefits.

Many families have found that credit card rewards can help offset costs for things like travel, groceries, and even cash back. According to a study by the Federal Reserve, over 83% of credit card users with rewards cards redeem their rewards annually, which can lead to significant savings

Understanding the specific rewards structure of your credit card can maximize these benefits without much extra effort.

Research rewards programs before choosing a card. Use apps or tools to track rewards. Redeem rewards for maximum benefit.

Related: Say Goodbye to Coupons and Hello to The Best Apps!

Using Credit Cards Will Harm My Financial Health

Some people believe that using credit cards will inevitably lead to poor financial health. This myth is often based on misunderstandings about how credit cards work.

Responsible use of credit cards can actually improve your financial health by helping you build credit, earn rewards, and manage cash flow. The key is to use credit cards within your means and pay off balances in full each month.

Set clear spending limits. Use credit cards for planned expenses. Monitor your account regularly.

Credit Cards Are Only for People with High Incomes

There’s a misconception that credit cards are only suitable for people with high incomes. In reality, credit cards can be beneficial for individuals and families at all income levels.

Credit cards can help manage cash flow, build credit, and provide a safety net for emergencies. Many credit cards offer rewards and benefits that can help lower-income families save money.

Look for credit cards with no annual fees. Use rewards to supplement income. Build credit to access better financial products.

Practical Tips for Families to Maximize Credit Card Benefits

Many credit cards offer rewards programs and cashback opportunities. These rewards can be used to offset everyday expenses or fund special family activities.

By using credit cards for routine purchases, families can accumulate rewards points or cashback. This can then be used to save money on future purchases.

Use points for family vacations. Look for travel benefits. Combine rewards with other savings strategies.

Real-Life Examples of Smart Credit Card Use

A survey by NerdWallet found that 47% of families using credit cards for routine expenses reported significant savings from rewards and cashback

Consider a family that uses a rewards credit card for their monthly grocery shopping. By paying off the balance in full each month, they avoid interest charges and accumulate points. At the end of the year, they redeem these points for a vacation, significantly reducing their travel expenses.

Another example is a family that uses a cashback card for all their utility and grocery bills. Over time, they accumulate enough cashback to cover a substantial portion of their holiday shopping expenses, easing the financial burden during the festive season.

The way we do it is my wife has a card, I have a card, our business has a card, and we have a card for our utilities and recurring expenses. Each card has its own purpose.

Related: The Art of Frugal Food Shopping: How To Save On Groceries

Conclusion

By understanding the truth behind these myths, families can make informed decisions. Implementing the tips and strategies discussed can lead to smarter credit card use and improved family finances.