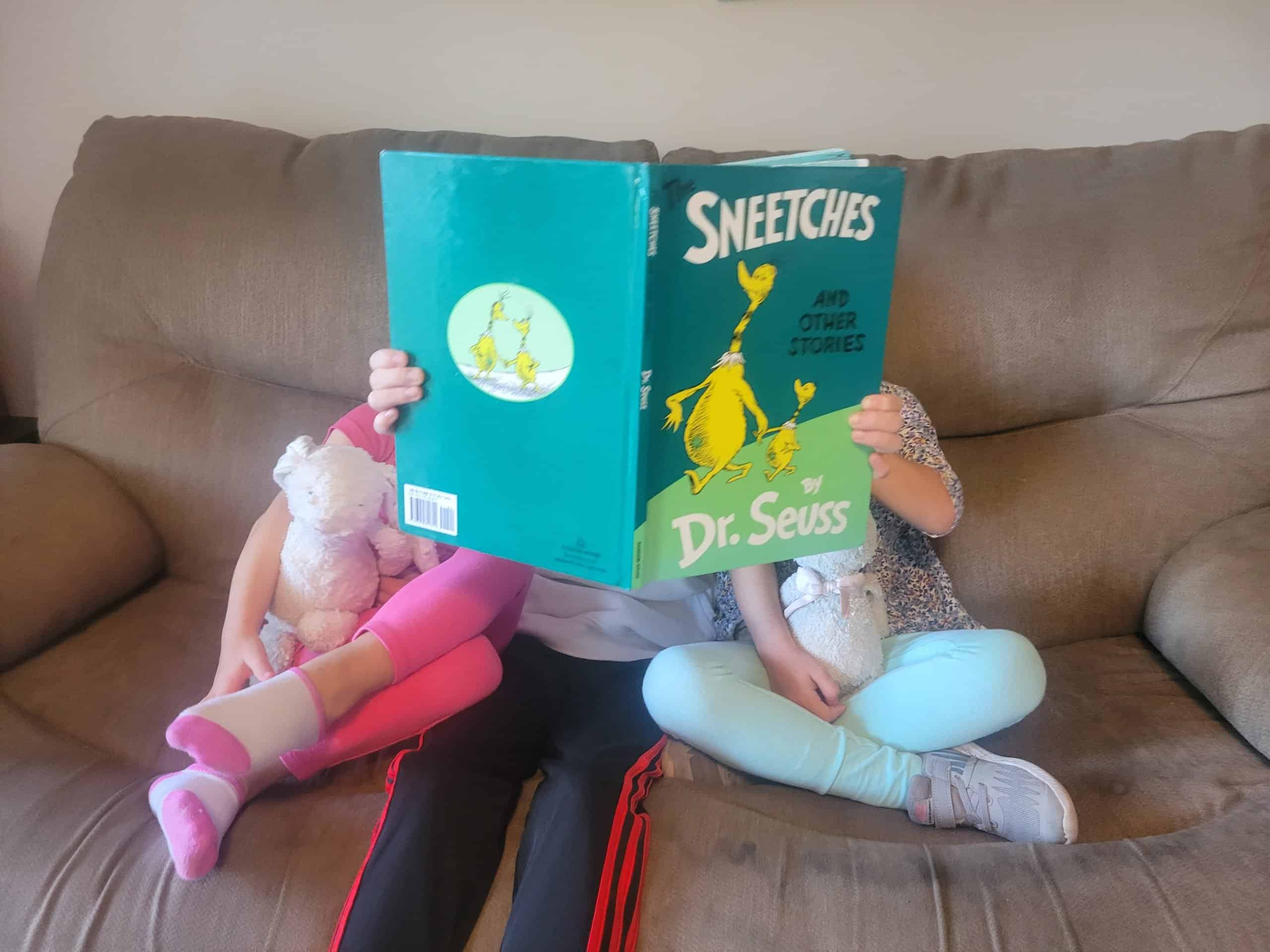

How I Teach Kids About Money By Getting Rid Of Their Stuff

As parents, we’ve all encountered the seemingly inexhaustible supply of toys, gadgets, and general kid stuff that seems to multiply in our homes. If you’re anything like me, you’ve probably looked around your house and wondered how you ended up with so much…stuff. But here’s the thing: this clutter, while visually overwhelming, presents an unexpected…