How much house can you afford?: The McDonald’s Principal

It’s hard to know how much house you can afford. Actually it’s easy to know how much house you can afford. It’s hard to know how much house you should afford.

Table of Contents

The McDonald’s Principal

When I bought my first house, I developed The McDonald’s Principal. It was simple, clever, and powerful. It was my way of trying to figure out how much house I can afford.

The goal was setting a budget to buy a house, and not foreclose on it. I did not care what amount an underwriter told me I was approved to borrow because I knew me better than they knew me.

I was 21 and making 35k a year. At that time I was a technical writer writing Windows 2000 certification at a time when the tech bubble was about to burst.

How much house you can afford matters if you do not want to lose your house.

My goal was simple. Do not lose my house. In my mind paying the mortgage a day late was losing my house.

I agreed to a mortgage and it was my duty to pay it back as promised (actually it was my duty to future me to pay it off sooner).

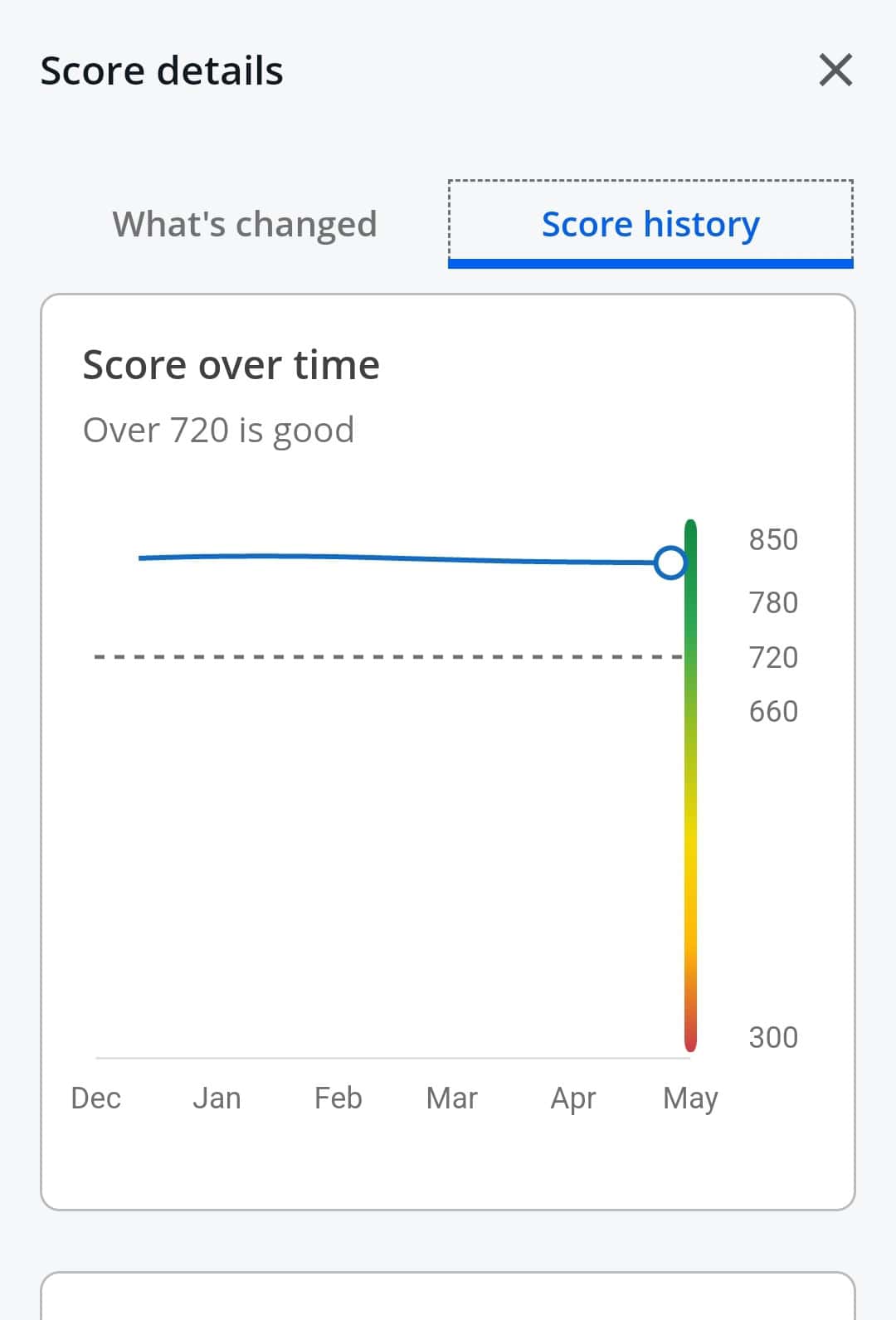

This sense of duty to lenders has led to decades of 800+ credit scores.

What is the McDonald’s Principal?

At the time, McDonald’s was paying about $8 an hour. The McDonald’s Principal was an idea I invented and stuck with.

It is simply that I considered working at McDonald’s my worst case scenario. If I lost my job and had to work at McDonald’s what could I afford? I based the house price and mortgage length off of that.

$8 an hour x 40 hours a week = $1280 a month. Add a roommate (which I did) and I could still live within budget. Budgets are critical.

The above is powerful. We don’t need to listen to what other people say we can afford. Live for you.

It’s also important to understand you. Where does your money go? Where are you spending it? Know this.

Live within your means

As I advanced in my career, I raised the bar to the QuikTrip Manager Principal, but the idea remained the same.

Live within your means. Buy the right size house. Anything additional you pay on a house is more risk that you lose the house.

The additional expense is also an opportunity cost because the additional savings can be invested to buy future you your time back.

Instead of buying more or better than you need to be happy, buy what satisfies you

Fun fact. A few days before closing on the house I was laid off. We closed anyway. I knew I could afford the house with a roommate, and if I couldn’t I knew how to rent it out for more than my mortgage.

Settling for a house you can afford is financially smart

Look it makes sense to buy a house that you can afford when times are bad because sometimes times are bad (anyone hear of COVID?).

But there’s another side to that coin. The money you are saving by buying a house that you can afford, instead of buying a house the lender says you can afford, is you can invest the difference.

The problem with a house that is nicer than you need is your money is tied up in something that doesn’t make you money.

If you are approved for $1,500 a month, consider buying a house that is $1,300 a month.

On a 30-year loan (which is way too long by the way), that is a $72,000 savings. Instead, put that $200 a month into a balanced portfolio that returns 5% over 30 years and you could have $166k.

This is just math. 5% is a fairly conservative portfolio on a 30-year time line.

Bottom line to determine how much can you can afford

Ignore what you are approved to borrow.

Lenders price in taking your house when they model how much do lend to you. They don’t want you to foreclose.

They make more money if you do not foreclose. But they do not have the safety net of selling your house if you do not pay them back.

So do not borrow what they approve you to borrow.

Instead, borrow an amount that you know that if things go bad you can still afford it. Your job is not promised to you. Neither is your house.

Borrow what you can afford in bad times, don’t borrow based on what you can afford in normal or good times.

Don’t lose your house.